🧨 The Lie of Risk

Why 97% of Day Traders Fail—And What the 3% Know That You Don’t

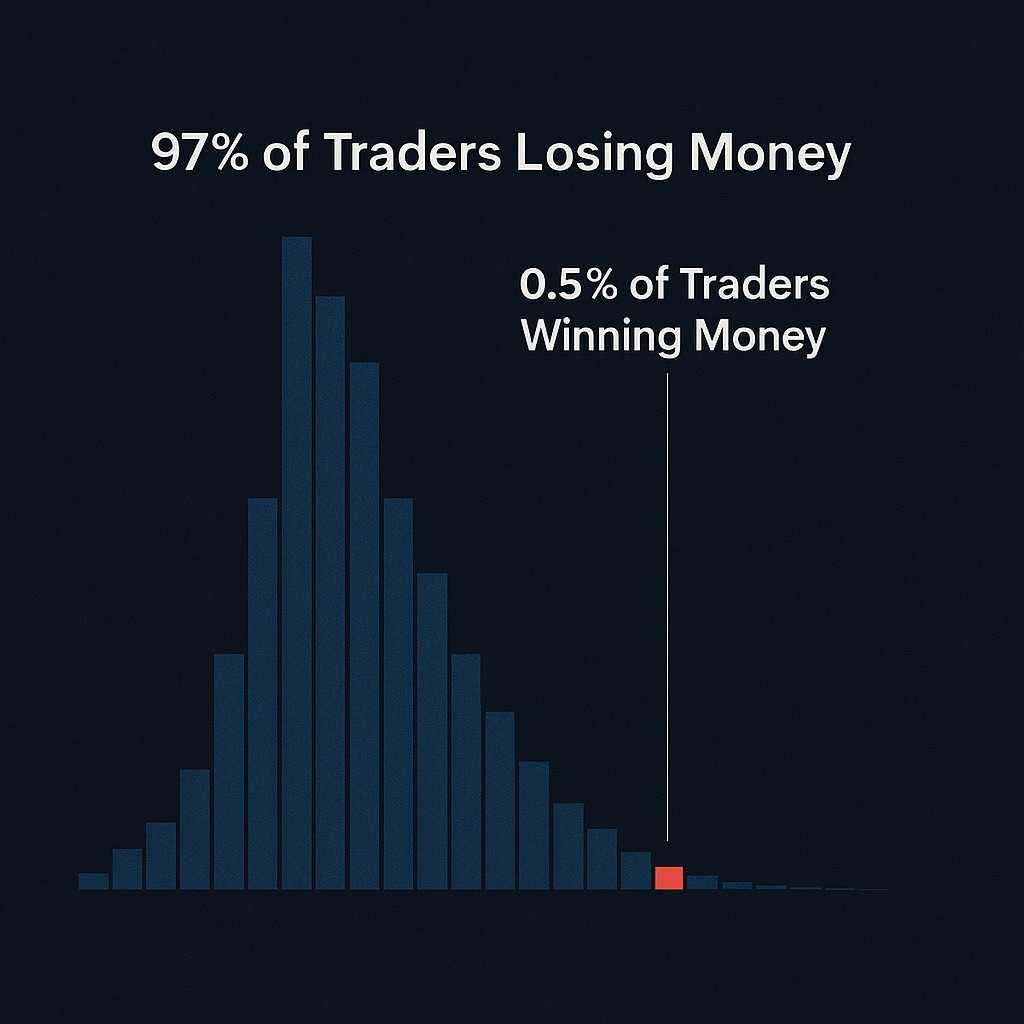

“Only 0.5% of day traders earned more than a bank teller’s starting salary. The rest? They lost money. Every. Single. One.”

—[SSRN Study, Chague et al., 2020]

🚧 The Delusion

Let’s be real—statistically speaking,

you’d be better off flipping burgers.

And I don’t say that to be dramatic.

I say it because the data backs it up. Cold and brutal:

📉 Out of 19,646 day traders studied over a 5-year span:

Only 1.1% made more than minimum wage

Only 0.5% beat a bank teller's entry-level salary

The “top” trader earned ~$310/day… but with a daily volatility of $2,560

“So basically, even the best guy had no idea if he’d make rent or go broke on any given day.”

So let me ask the question you’re afraid to say out loud:

If everyone fails… why are you trying to trade for a living?

🎭 The Real Scam

Let’s address the elephant in the trading room:

You’ve been lied to.

Every guru, ad, and free masterclass...

They’ve all sold you a dream. And the dream is toxic.

“You just need a strategy.”

“Learn to manage risk.”

“Stick to your plan and stay disciplined.”

But here’s the part they don’t tell you:

👉 They’re not trading. You are their product.

Their edge is you—your attention, your credit card, your pain.

And every time you lose a trade and go looking for a fix, you feed their funnel.

That’s the external scam.

But there’s an internal one too—the lie we tell ourselves:

“If I just follow the rules perfectly, I’ll make money.”

No. You won’t.

Not until you rewire the way you think about risk.

🧠 The Risk Management Trap

Let’s talk about the most misunderstood part of trading:

Risk management isn’t about numbers. It’s about your psychology.

You’ve been told to:

Use a 1:2 or 1:3 risk/reward

Only take A+ setups

Let your winners run

But here’s the raw truth:

Every setup is different

Every session is different

And the market doesn’t give a damn about your R:R model

You’re following someone else’s playbook in a game where the rules are written in blood.

Let me put it another way:

You’re not managing risk. You’re outsourcing responsibility.

And that’s why your “edge” feels like it’s constantly failing.

💵 The $100 Test

Let me hit you with a mindset bomb:

If I walked up right now and offered you a crisp $100 bill,

would you take it?

Of course you would.

You’d be a fool not to.

So answer me this:

Why do you reject $100 when the market offers it?

You hold out.

You wait for $200.

You want the big win.

But here’s what you’re really saying:

“This money right here, right now, isn’t good enough for me.”

And I get it.

That was me for years.

I thought leaving money on the table meant I was doing it wrong.

Turns out, I was just being greedy.

GREED. That voice in your head that says “just a little more.”

The one that always ends with a reversal and regret.

Here’s the flip:

Don’t let greed keep you broke. Let gratitude make you consistent.

🔄 Flip the Script

Here’s how I survived.

I flipped the whole damn framework.

Instead of trying to force 2R out of every trade, I started asking:

Is the market offering me money right now?

Can I take that and protect myself?

Can I stay in the game long enough to play another day?

And that’s where I found the truth:

“It’s not about maximizing return. It’s about minimizing regret.”

Now I take profit early and often.

Now I protect my capital like it’s oxygen.

Now I define a “good trade” as one that pays—not one that fits someone else's textbook.

📖 My Story (And Why This Matters to You)

When I started, I wasn’t dumb.

I was dedicated. Disciplined. Obsessive.

But I still lost.

Not because I lacked strategy.

But because I lacked perspective.

Every time I forced a trade to meet my expectations, I lost.

Every time I waited for the market to hit my dream R:R, I gave money back.

Everything changed the moment I stopped asking the market to meet my needs and started listening to what it was actually offering.

And now?

I trade less.

Because I learned the most important skill in trading:

Let go of control. Take what’s offered. Protect your downside.

That mindset saved me.

That mindset feeds my family.

And that mindset can work for you.

⚙️ Nuts & Bolts

Let’s land the plane:

✅ Yes, define your edge

✅ Yes, study your data

✅ Yes, track setups and trade logs

But…

🚫 Stop letting fantasy risk models guide your real-time execution

🚫 Stop forcing the market to give you what you want

🚫 Stop passing up real money for the idea of more

Because here’s what no one tells you:

Profit isn’t potential. Profit is payment for the work you did to get here; take it.

Your job is to get paid.

And the traders who survive? They get really good at taking the money and getting the hell out.

🥷 Final Word: Take the Money

You can have all the knowledge in the world.

But until you shift your mindset around risk…

You’ll keep giving it back.

So take the damn $100.

Rewire your definition of success.

Detach from the fantasy.

Trade like you’re in a war zone—and every dollar is a win.

You don’t need the market to cooperate.

You need to stop sabotaging yourself.

The coach in your corner,

Stephan

Really good advice! Like the song says, take the money and run.

💥 Let’s get real about “risk.”

You’ve been told risk is about percentages, stop losses, and position sizing. But the real danger? It’s not in the market—it’s in you.

📉 The market doesn’t kill your edge. You do.

By hesitating when it’s time to act

By forcing trades when patience was needed

By chasing perfection instead of progress

🧠 True risk is internal.

It’s the fear, the doubt, the ego-driven need to control outcomes.

📖 Taoist Wisdom:

"He who knows others is wise; he who knows himself is enlightened."

🔍 Reflection Prompt:

Where are you mistaking internal fear for external risk?

How can you shift from controlling outcomes to mastering your process?

💬 What’s one internal risk you’ll confront this week to strengthen your trading edge?